BLXM Token Foundry to jump-start liquidity and community engagement.

Two months after launching the BLXM token, the bloXmove team is taking things to the next level by announcing some important milestones on our roadmap:

- Liquidity Rewarding to start January 2022

- Token Staking to start within Q1 2022

- First PoC with Energy Web Foundation and 50Hertz live Q1 or Q2/2022

- Initial release of bloXmove DID-based access control protocol on Ontology Q2/2022

- First commercial mobility pilots in closed-loop production within Q2 2022

- Mainnet (open-loop) launch by Q3/Q4 2022

- Market entry into APAC and China Q4 2022

Starting with the new year, we will provide continuous reporting on these milestones to the community via Medium, Telegram and Twitter.

The BLXM Token Foundry and its incentive program

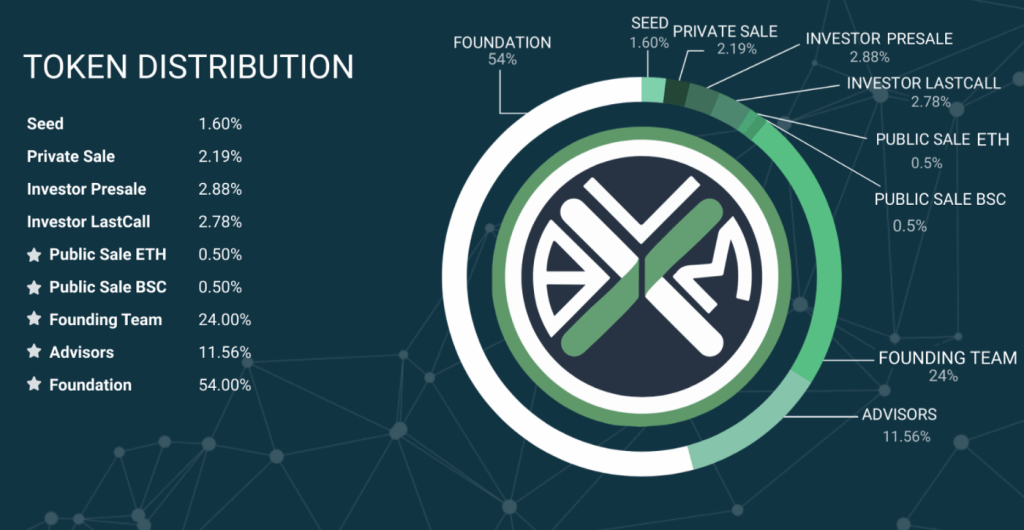

At the time of the BLXM token generation event (TGE), “The Foundation” held 54% of all BLXM tokens. Management, allocation and utilisation of this token pool is handled by the treasury of the bloXmove platform.

The Foundation’s treasury manages the liquidity of BLXM towards platform (“internal liquidity”) as well as market (“external liquidity”).

It also supports the ongoing development of the protocol, the technology, the underlying platform and most of all the community of BLXM stakeholders.

In addition the treasury supports bloXmove’s mission of achieving net-zero, carbon-neutral mobility.

In this spirit, the BLXM Token Foundry has decided to commit up to 25% of its treasury to reward programs. Over time the program will reward:

- Liquidity

- Staking

- Sustainable Mobility

- Carbon Credits

Liquidity Rewards programs to start January 2022

Our first reward program will be to reward liquidity with a simple first-come first serve rewarding mechanism:

The Foundation commits to reward community members providing liquidity with BLXM tokens from its own treasury pool. Note that these are tokens which are fully vested and were originally allocated to be released into the markets for funding purposes.

Happy New Year — and this is our gift to the BLXM community

In order to get this program out of the door as soon as possible we have decided to start with an external solution provider for the first 45 days while we build our own more comprehensive solution.

Terms:

Start of staking: Jan 2nd, 2022

Total Reward: 36,000 BLXM tokens to be paid out in

daily chunks of 36,000 / 45 = 800 BLXM

Minimum staking period: 30 days

Second phase of liquidity program

While we operate the whitelabel ‘simple’ liquidity staking program, our internal developers are working on an improved and more flexible program.

In this program, which will start in Feb. 2022, total rewards will be continuously committed and communicated three months in advance, starting with, for example:

50,000 BLXM for the first,

75,000 BLXM for the second, and

100,000 BLXM for the third month.

The total amount of reward, e.g. 50,000 BLXM in the first month will be spread among all liquidity providers. This will be calculated daily.

We will allow for unlocked liquidity but reward locking with a higher share of the reward pool. All BLXM tokens earnt will unlock at the same time as the principal liquidity.

Each month of locking will be rewarded by a 10% increase in reward allocation. This reward allocation will be compounded, i.e. the share of total rewards assigned to liquidity for 3 month of locking will be 133% of that rewarded to unlocked liquidity, while the rewards allocated to liquidity with 6 months of locking comes to 177%.

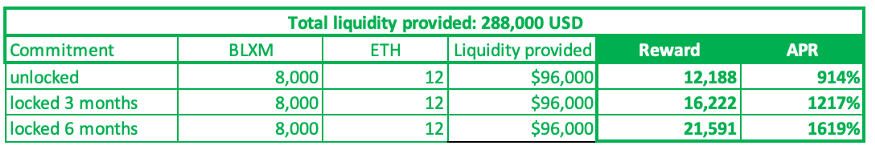

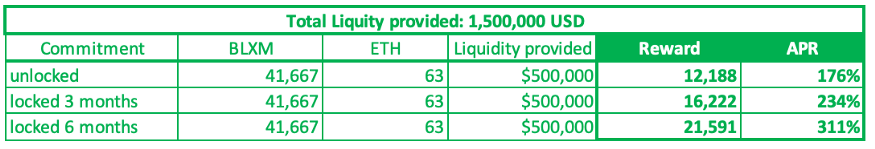

To understand what that means in terms of APR, we provide two scenarios for clarification.

For ease of explanation, both scenarios assume a constant price for both tokens in the liquidity pair:

BLXM: USD 6.0 and ETH: USD 4,000

We are showing the two scenarios for the second month, i.e. total rewards of 50,000 BLXM allocated to the total liquidity pool — irrespective of its size.

The two scenarios are:

1. Total value of liquidity provided 288,000 USD

2. Total value of liquidity provided 1,500,000 USD

Note that the total reward is 50,000 BLXM — irrespective of the size of the liquidity pool.